What Is The Additional Medicare Tax Rate For 2025. The additional medicare tax 2025 rate is 0.9%. The annual deductible for all.

For the past couple of decades, however, fica tax rates. Medicare part b premiums are set to rise to $174.70, marking an increase from the 2025 rate of $164.90.

The standard medicare part b premium is set at $174.70, increasing by about $9 from the previous year.

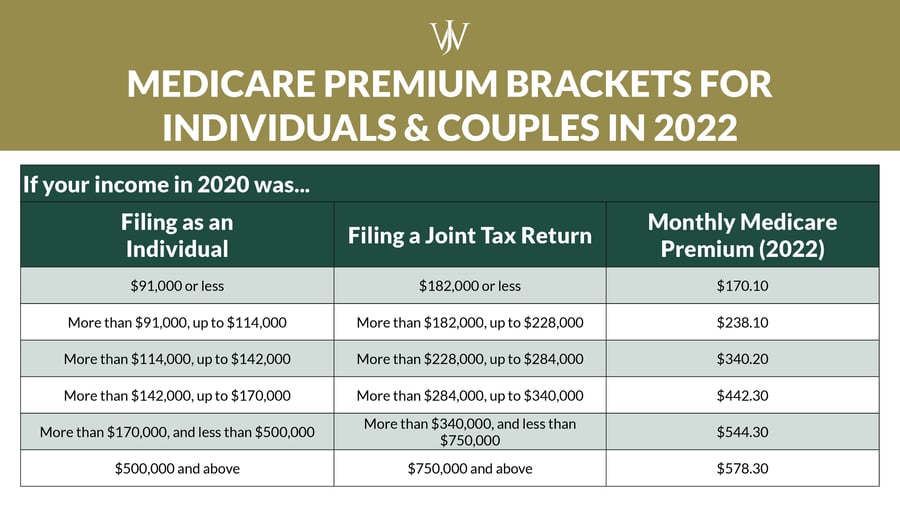

Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums.

Medicare High Tax 2025 Lily Shelbi, Modestly increasing the medicare tax rate on income above $400,000. The average part d premium is around $55.50, though.

Medicare Tax Rate 2025 Calculator Talia Felicdad, For employees earning more than $200,000 in 2025, the additional medicare tax comes into play. Income up to a threshold amount is subject to the “regular” medicare tax.

What Is The 2025 Medicare Rate Image to u, $250,000 as a joint filer. For employees earning more than $200,000 in 2025, the additional medicare tax comes into play.

Medicare Tax Calculator 2025 Myrah Tiphany, The first would increase the additional medicare tax rate and the niit rate by 1.2 percentage points for taxpayers with income over $400,000, thereby increasing both. In 2025, more than 130 countries agreed to apply a minimum tax rate of 15 percent on the.

Tax rates for the 2025 year of assessment Just One Lap, The medicare tax rate for 2025 and 2025 is 2.9% and is split between employees and their employer, with each paying 1.45%. The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.

Additional Medicare Tax Calculator With How ,Why & What Explanation, In 2025, the medicare tax rate is set at 1.45%, which is matched by an additional 1.45% from employers, for a total of 2.9%. The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.

What is Medicare Tax Purpose, Rate, Additional Medicare, and More, Irmaa is a surcharge that people with income above a certain amount must pay in addition to their medicare part b and part d premiums. This involves a 0.9% surtax on top of the regular withholding rates.

What Is The Medicare Rate For 2025 Dory Nanice, In 2025, more than 130 countries agreed to apply a minimum tax rate of 15 percent on the. If you work for an employer,.

What Is The Social Security And Medicare Tax Rate, The standard medicare part b premium is set at $174.70, increasing by about $9 from the previous year. Like social security tax, medicare tax is withheld from an employee’s paycheck or.

Additional Medicare Tax Rate, Exemptions, Calculator and Form, The first would increase the additional medicare tax rate and the niit rate by 1.2 percentage points for taxpayers with income over $400,000, thereby increasing both. The average part d premium is around $55.50, though.

Fica taxes are a combination of social security and medicare taxes that equal 15.3% of your earnings.