What Is Hsa Limit For 2025. For example, in 2025 you can't contribute more than 10/12 of the $8300 to your hsa, but you could contribute the entire 12/12 (or any other fraction) to your. You can contribute up to.

2025/2025 HSA Limits Corporate Benefits Network, Hsa limits 2025 over 55. Irs releases health savings account limits for 2025.

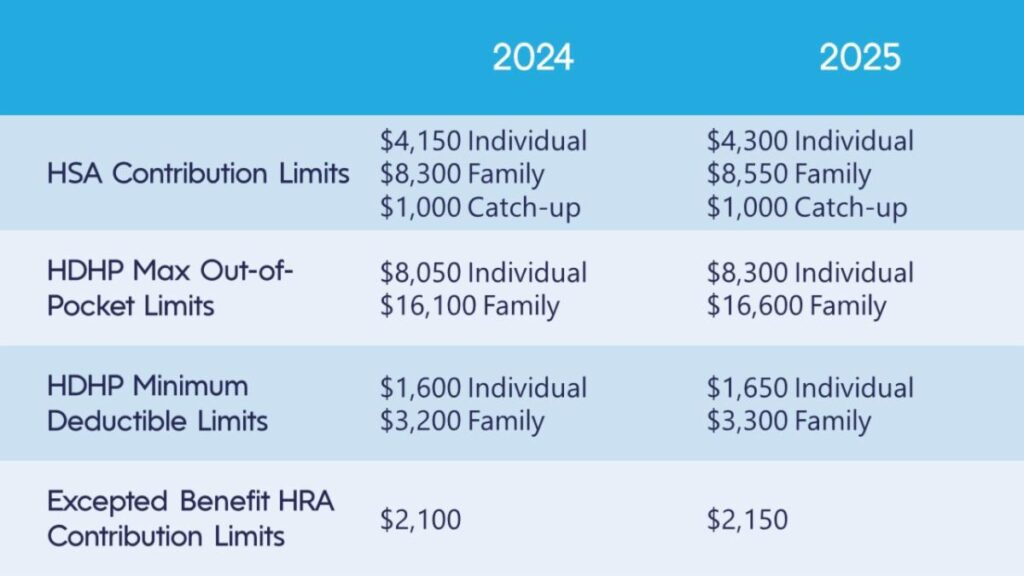

Savings Boost IRS Raises HSA Contribution Limits for 2025, Health savings account (hsa) contribution limits. The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300.

Maximize HSA Savings in 2025 New Contribution Limits Revealed DSP, This alert outlines the 2025 hsa limits and offers additional information on limits imposed by the affordable care act (aca). Your contribution limit increases by $1,000 if you’re 55 or older.

HSA Contribution Limits for 2025 and 2025, Health savings account (hsa) contribution limits. The 2025 hsa contribution limit for individual coverage increases by $150 to $4,300.

2025 HSA Max Contribution Limit Update and Prediction YouTube, For 2025, the minimum deductible amount for hdhps will increase to $1,650 for individual coverage and $3,300 for family coverage. The maximum contribution limits for health savings accounts (hsas) have been updated.

Your Employee Benefits Partner Vita Companies, This alert outlines the 2025 hsa limits and offers additional information on limits imposed by the affordable care act (aca). The irs has released the 2025 hsa maximum contribution limits.

Health Savings Account (HSA) and HighDeductible Health Plans (HDHP, The irs has released the 2025 hsa maximum contribution limits. See below for changes from 2025 to 2025:

Limits Announced.png)

2025 HSA Contribution Limits, 2025/2025 hsa limits corporate benefits. Hsa limits 2025 over 55.

Significant HSA Contribution Limit Increase for 2025, Find out the max you can contribute to your health savings account (hsa) this year and other important hsa account rules. See below for changes from 2025 to 2025:

HSA & EBHRA Limits for 2025 HRPro, Hsa limits 2025 over 55. 2025/2025 hsa limits corporate benefits.

For 2025, the minimum deductible amount for hdhps will increase to $1,650 for individual coverage and $3,300 for family coverage.